Cardano has emerged as a major player in the cryptocurrency landscape, captivating investors and enthusiasts alike. With its robust technology and commitment to sustainability, many are now speculating whether the price of Cardano could soar to an astonishing $1,000. This ambitious target has sparked a wave of interest, as investors seek to understand the factors that could drive such significant growth.

As the crypto market evolves, Cardano’s unique features, including its proof-of-stake consensus mechanism and smart contract capabilities, position it for potential breakthroughs. Investors are keen to analyze market trends, technological advancements, and broader economic conditions that could influence Cardano’s trajectory. In this article, we’ll explore the possibilities and challenges surrounding this bold price prediction, offering insights that could help investors navigate the exciting yet volatile world of cryptocurrency.

Table of Contents

ToggleOverview of Cardano

Cardano represents a cutting-edge blockchain platform designed for the development of decentralized applications and smart contracts. It utilizes a unique proof-of-stake consensus mechanism, called Ouroboros, which enhances scalability and security. Cardano’s architecture separates the settlement layer from the computation layer, allowing for greater flexibility in transaction processes.

Founded by Charles Hoskinson in 2015, Cardano seeks to address various challenges faced by earlier blockchain systems, such as interoperability and energy efficiency. Its focus on sustainability involves utilizing a more energy-efficient approach compared to traditional proof-of-work models.

Cardano’s native cryptocurrency, ADA, plays a crucial role within its ecosystem. ADA serves multiple functions, including staking for network security, participating in governance decisions, and facilitating transactions on the platform. Market aspects surrounding ADA, including supply, demand, and investor sentiment, significantly influence its price trajectory.

Recent technological advancements, such as the introduction of smart contracts in September 2021, position Cardano as a strong player in the competitive blockchain landscape. Ongoing developments like improved interoperability with other blockchains and enhanced scalability features may further affect ADA’s market value, potentially paving the way for significant price milestones, including the optimistic prediction of reaching $1,000.

Current Price Analysis

Cardano’s price movements warrant close scrutiny, as various factors influence its market behavior. Recent trends indicate a growing interest in ADA, tied to its versatility and technological foundation.

Historical Performance

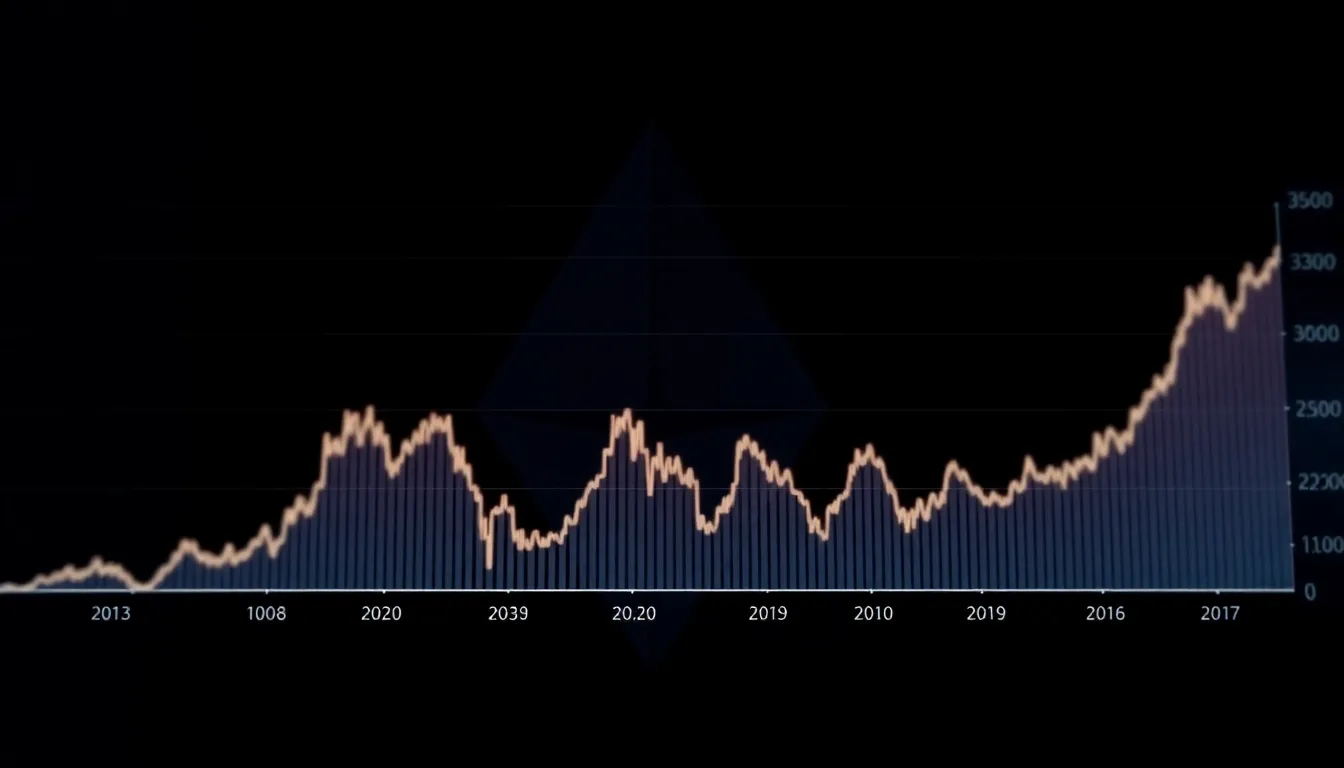

Cardano’s historical price patterns reveal significant volatility, with notable highs and lows. In 2021, ADA reached an all-time high of approximately $3.10, fueled by increased adoption and market enthusiasm. The subsequent corrections showcased typical market behavior, with prices fluctuating between $1.00 and $2.50 throughout 2022. Year-to-date increases in 2023 suggest a resurgence in investor confidence, reflecting overall positive market sentiment toward Cardano’s long-term viability.

Market Trends

Market trends indicate a shift toward sustainability and scalability in the cryptocurrency sector, benefiting Cardano. Increased institutional interest and the rise of decentralized finance (DeFi) products on Cardano’s platform contribute to its growing market presence. Additionally, macroeconomic factors, such as inflation concerns and regulatory developments, can drive speculative trading around ADA. Tracking these trends provides insights into Cardano’s potential for significant price movements, specifically the pathway toward the $1,000 milestone.

Factors Influencing Cardano Price

Multiple factors influence Cardano’s price trajectory as it seeks to reach the ambitious milestone of $1,000. These elements include technological developments, market sentiment, and economic indicators.

Technological Developments

Technological advancements drive Cardano’s progress and market performance. Launches of features like smart contracts enhance functionality and attract developers, improving user engagement. Upgrades to the Ouroboros consensus mechanism increase transaction speed and network security, laying a robust foundation for Cardano’s growth. Ongoing innovations from the Cardano team, including interoperability enhancements, cater to a wider audience, potentially increasing demand for ADA.

Market Sentiment

Market sentiment significantly impacts Cardano’s pricing dynamics. Positive news coverage can boost investor interest and encourage buying activity, while negative news may prompt sell-offs. Social media platforms and community discussions shape public perception of Cardano, influencing short-term price movements. Investor behavior, propelled by sentiment analysis and trends, often reflects in ADA’s performance, where emotional reactions can lead to increased volatility.

Economic Indicators

Economic indicators provide context for Cardano’s value in the broader market. Factors such as inflation rates, GDP growth, and regulatory changes affect investor confidence across cryptocurrency markets. For instance, favorable economic conditions can drive more institutional investment into Cardano, elevating its price. Conversely, economic downturns or negative regulatory developments may hinder growth, complicating Cardano’s path to reaching higher value thresholds like $1,000. Tracking these indicators helps predict potential shifts in ADA’s market performance.

Price Prediction Models

Price prediction models for Cardano (ADA) focus on both technical and fundamental analysis to gauge its potential movements toward reaching $1,000. These analyses provide insights into market trends, investor behavior, and underlying factors that influence ADA’s value.

Technical Analysis

Technical analysis employs historical price data and volume to identify patterns and predict future movements. Key indicators include:

- Moving Averages: Analysts use simple and exponential moving averages to determine trend direction. Bullish trends appear when the short-term average crosses above the long-term average.

- Relative Strength Index (RSI): The RSI measures momentum changes. Values above 70 indicate overbought conditions, while values below 30 signal oversold conditions, guiding entry and exit points.

- Chart Patterns: Patterns like head and shoulders, flags, and triangles offer projections based on historical price behavior. Identifying these patterns helps traders anticipate potential price spikes.

- Volume Analysis: An increase in trading volume during price increases often indicates strong interest and validates trends, while low volume can suggest weakness.

Technical analysis provides crucial insights, allowing traders to make informed decisions based on market sentiment and price history.

Fundamental Analysis

Fundamental analysis assesses the intrinsic value of Cardano, considering various factors that influence its long-term growth. Core elements include:

- Project Developments: Upgrades to the Cardano network, such as the introduction of smart contracts and interoperability solutions, attract developers and users, enhancing ADA’s utility.

- Regulatory Landscape: Regulations in key markets can significantly impact investor confidence. Clarity on regulatory frameworks often drives investment into ADA, fostering price stability and growth.

- Adoption Rates: Increased adoption among businesses and consumers strengthens demand for ADA. Partnerships and collaborations indicate a broader acceptance within the crypto and traditional markets.

- Market Conditions: External factors like economic indicators and global market trends influence overall investor sentiment. Factors such as inflation or shifts in monetary policy can affect ADA’s price trajectory.

Fundamental analysis aids investors in understanding the underlying forces driving Cardano’s growth and predicting its potential to reach the desired price point of $1,000.

Expert Opinions

Experts in the cryptocurrency field provide varied insights into Cardano’s potential price trajectory toward $1,000. Analysts consider multiple elements influencing ADA’s valuation, emphasizing both technological advancements and market dynamics.

- Market Sentiment: Analysts highlight the importance of market sentiment in driving prices. Positive developments, partnerships, or regulatory clarity often lead to increased demand for Cardano, which can push prices upward.

- Technological Advancements: Experts note Cardano’s continuous improvements, such as enhanced smart contract capabilities and scaling solutions. These upgrades not only improve user engagement but also foster adoption among developers, potentially leading to a higher market value.

- Historic Performance Analysis: Analysts reference ADA’s historical price movements to identify patterns. Past performance indicates periods of substantial growth, showing how market conditions can significantly impact Cardano’s price.

- Macro-Economic Factors: Economists stress that global economic conditions, including inflation rates and economic stability, influence cryptocurrency investments. Positive economic indicators can increase investor confidence and interest in ADA.

- Technical Indicators: Technical analysts utilize tools like moving averages and the Relative Strength Index (RSI) for predictions. These indicators help forecast potential price movements and signify market trends that could lead ADA toward the $1,000 goal.

- Regulatory Environment: Experts express concern about the effect of regulations on ADA’s growth. Clear regulations can instill investor confidence, while uncertain regulatory landscapes may hinder growth.

- Adoption Rates: Analysts emphasize the significance of rising adoption rates among users and businesses. Increased use of Cardano in decentralized applications and services may bolster demand and influence price increases.

By examining these expert opinions, investors gain insights into the multifaceted factors that could drive Cardano’s price toward the ambitious target of $1,000.

The potential for Cardano’s price to reach $1,000 is fueled by its innovative technology and growing market presence. As developments in scalability and sustainability continue to unfold, investors are watching closely. The interplay of market sentiment and institutional interest will be crucial in shaping ADA’s future value.

With a strong foundation in proof-of-stake mechanisms and a focus on user engagement, Cardano is well-positioned to capitalize on emerging trends in the cryptocurrency space. As the ecosystem evolves, the ambitious target of $1,000 remains within reach, contingent on ongoing advancements and favorable market conditions.